Employee Ownership Trusts (“EOT”) were first introduced in 2014 to facilitate more businesses being wholly or partly owned by employees.

There are some generous tax breaks on offer to encourage business owners to consider the EOT model.

What actually is an EOT?

A trust is set up which will hold all or some of the shares in the company. In order to benefit from the tax breaks the trust must own more than 50% of the shares in the company.

The trust will be operated for the benefit of the employees of the company. The trust is run by its trustees, which could include members of the management team, but given that its purpose is to hold the directors to account, it should be sufficiently independent to enable it to do this. It is necessary to demonstrate to HM Revenue & Customs that control of the business has passed to the EOT and having the trustees dominated by the original shareholders /directors would make this very difficult.

How does it work in practice?

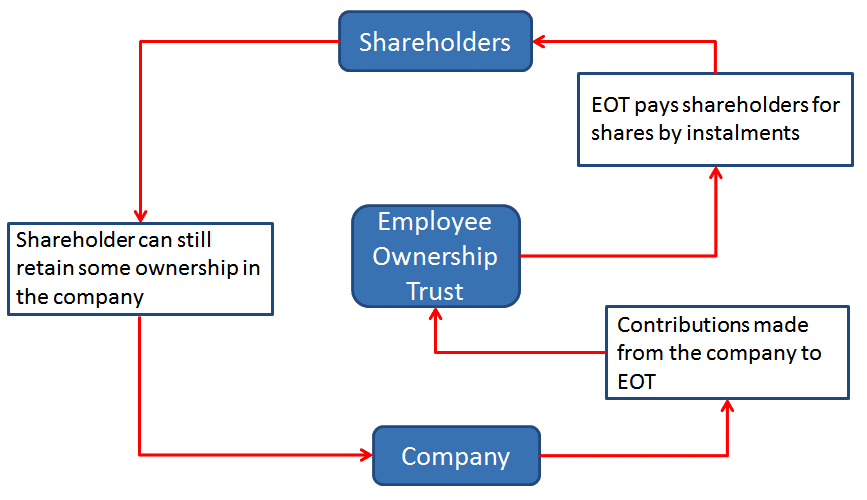

For new businesses, the EOT model could be put in place from the outset. For existing businesses, the shareholders would sell all or some of their shares to the EOT.

An independent market rate valuation of the business should be obtained which would set the sale price of the shares.

The company would make a contribution to the trust enabling it to pay for the shares. Depending on the funds available, a loan may have to remain between the trust and sellers which would be repaid over a period of time as the company generates future profits.

It may be possible for the company /trust to raise finance to help pay for the shares over a shorter period. The original business owners, post disposal, are able to retain some ownership in the business, keep their posts as directors and also receive market rate remuneration packages.

The company will continue to be run by the management team on a day to day basis, although they will now be answerable to the trustees of the EOT.

Tax breaks

Shareholders are able to sell their shares to the EOT free of Capital Gains Tax. With the recent reduction in Entrepreneur’s Relief this is even more attractive.

Income tax free bonuses of up to £3,600 per year can be paid to each employee.

What are the benefits of an EOT?

There are a number of benefits for the different business stakeholders.

Existing Business Owners

- Capital Gains Tax free

- Ready and willing buyer for the business

- Reassurance that the business will continue as a going concern

- Able to retain some ownership in the business

Employees

- Tax free bonuses

- A sense of ownership

The Company

- An engaged workforce

- Ensured long term future

- Can continue with minimal disruption

- A more innovative and forward thinking culture

The employee ownership model may not be suitable for all businesses, but it is fast becoming a popular choice for businesses who recognise the value of their most important resource.

An EOT is just one type of employee ownership model and other options such as share schemes should also be considered.

If you have any questions, our team of expert Accountants would be happy to assist.

Disclaimer: Content posted is for informational & knowledge sharing purposes only, and is not intended to be a substitute for professional advice related to tax, finance or accounting. Each comment posted by third party readers/subscribers of our website on topics of tax and accounting is their personal opinion and due professional care should be taken by you before you act after reading the contents of that post. No warranty whatsoever is made that any of the posts are accurate and is not intended to provide, and should not be relied on for tax or accounting advice.